This article provides an objective and analytical overview of accessing real-time market data through a stock market API.

The fundamentals of APIs are explained, followed by a discussion on the retrieval of real-time market information and the integration process with the API.

Additionally, insights on analyzing market data are explored, along with best practices for optimizing API usage in real-time trading scenarios.

This academic-style introduction aims to provide readers with a technical understanding of accessing real-time market data through a stock market API.

API Basics: Understanding the Fundamentals

The fundamentals of stock market API basics involve understanding the underlying concepts and principles that govern the functionality and usage of application programming interfaces. Two important aspects to consider when working with APIs are security and scalability.

API security is crucial in protecting sensitive data. To ensure this, developers need to implement proper authentication mechanisms, such as API keys or tokens, to control access to the API endpoints. Additionally, encryption techniques can be employed to secure data transmission between clients and servers.

API scalability refers to the ability of an API system to handle large volumes of requests without compromising performance. This can be achieved by employing various strategies like load balancing, caching, and using distributed systems. These measures enable efficient handling of requests even during peak times or high traffic situations.

Understanding these fundamental concepts in API basics is essential for developers in order to create robust and reliable APIs that maintain data security while efficiently handling a large number of requests.

Data Retrieval: Accessing Real-Time Market Information

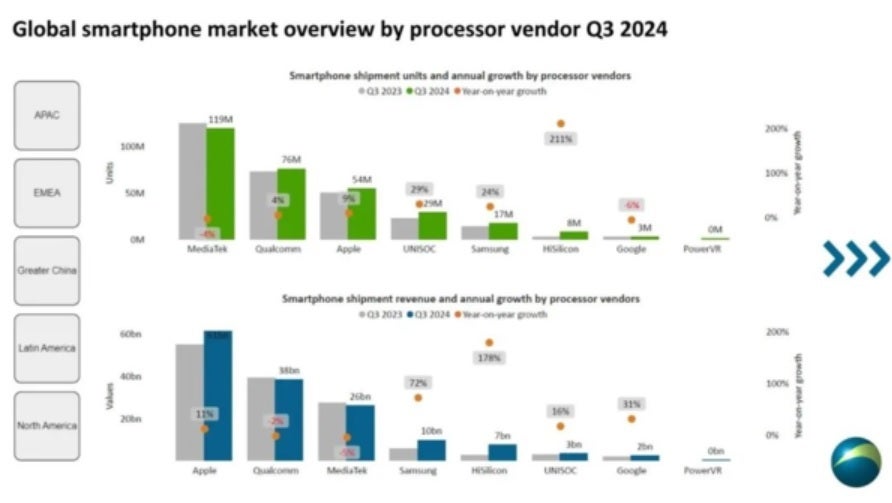

One can retrieve timely and up-to-date information pertaining to the financial market by utilizing relevant application programming interfaces (APIs). These APIs provide a convenient way to access real-time market data, allowing users to stay updated on the latest market trends.

By leveraging these APIs, users can gather information such as stock prices, trading volumes, and other relevant metrics without delay. Additionally, APIs enable developers to integrate this data into various applications and platforms for further analysis or visualization.

Market data visualization is particularly valuable in understanding complex market dynamics and identifying patterns or trends that may inform investment decisions.

Real-time market trends are crucial for traders and investors who rely on accurate and current data to make informed choices in an ever-changing financial landscape.

API Integration: Connecting to the Stock Market API

By integrating with the relevant application programming interfaces (APIs), users can establish a connection to retrieve live information on stock prices, trading volumes, and other essential metrics in order to analyze market dynamics for informed investment decisions.

API integration allows users to access real-time data from stock market APIs by authenticating their requests. API authentication is crucial to ensure that only authorized users can access the data and maintain the security of sensitive financial information.

Error handling is another important aspect of API integration. It involves implementing mechanisms to handle errors that may occur during the retrieval process, such as network connectivity issues or invalid requests. Proper error handling ensures that users are notified about any problems encountered while accessing real-time market data and allows for prompt resolution of issues, enhancing the overall reliability and usability of the stock market API integration process.

Data Analysis: Extracting Insights From Market Data

Data analysis involves extracting meaningful insights from the information retrieved through integration with relevant APIs, allowing users to make informed investment decisions based on the dynamics of stock prices, trading volumes, and other essential metrics.

Through data visualization techniques, such as charts and graphs, users can gain a visual representation of the market data, facilitating a better understanding of trends and patterns. This aids in identifying potential opportunities or risks in the stock market.

Additionally, predictive modeling techniques can be applied to forecast future market behavior based on historical data and other relevant factors. By utilizing these analytical tools and methodologies, investors can enhance their decision-making process by reducing uncertainties and increasing accuracy.

The combination of data analysis, visualization, and predictive modeling empowers investors to optimize their investment strategies based on evidence-backed insights derived from comprehensive market data.

Best Practices: Optimizing API Usage for Real-Time Trading

Optimizing API usage for real-time trading involves implementing efficient strategies to ensure timely access to and retrieval of up-to-date information, thereby facilitating informed decision-making by investors.

Real-time trading strategies require a high level of responsiveness and accuracy in accessing market data. One important consideration is API rate limiting, which restricts the number of requests that can be made within a given time frame. By effectively managing API rate limits, traders can avoid exceeding usage thresholds and ensure continuous access to real-time data.

Additionally, employing caching techniques can help reduce the number of API calls required, improving system performance and reducing latency. Implementing parallel processing mechanisms can also enhance efficiency by allowing multiple requests to be processed simultaneously.

Effective optimization of API usage for real-time trading requires careful planning and consideration of these strategies to maximize performance and enable timely decision-making in dynamic market conditions.